Is the recession closer? How bad it will be? Who will suffer more from it? Actually it’s already here!! Hold your seatbelts, let’s listen to what the experts says..

The inflation reached 11% in the U.S. alone, what else you need to know?

Billionaire Elon Musk has made some bold predictions in the past, most of were about his electric car company Tesla. This time he’s making a different prediction, a much more serious one regarding the entire US economy.

In this article we break down some shocking tweets, that seem to indicate that Elon has some extremely bearish thoughts regarding the US markets. Considering he’s a billionaire whose net worth is tied to a stock that is extremely sensitive to a recession, his latest opinions are stunning

We start with the tweets, it begins with New York times reportern, Christopher M tweeting out this : « claiming that there are over 936 startups, valued at above 1 billion dollars ».

Elon Musk responds by saying: “if history is any guide, not many will make it past the next recession”, as a side note here, Musk is well versed in surviving recessions, Tesla according to him, was about a month away from bankruptcy during the 2007 economic collapse.

but it’s the next tweet that draws the most interesting response, a user name Zack asks the following « when do you believe the next recession will be?»

and for a billionaire who’s got a lot on the line, he says something relatively detailed and shocking, he responds with this « predicting macroeconomics is challenging to say the least, my gut feel is maybe around spring or summer 2022, but no later than 2023 ».

Let’s break that down, so Elon is essentially saying that predicting the future of the economy in the long term is challenging, but according to his gut, he thinks economic problems are quickly approaching, we know that the federal reserve plans to raise the rate three times this year in 2022, and there are talks of demand being crushed by these actions, yet tesla’s most recent quarterly result seems to indicate great news, they posted some serious stats that blew out analysts expectations, so the big question is, why would Elon say something like this? this can’t possibly be just a gut feeling ?and is likely an opinion strung together by other various pieces of data?.

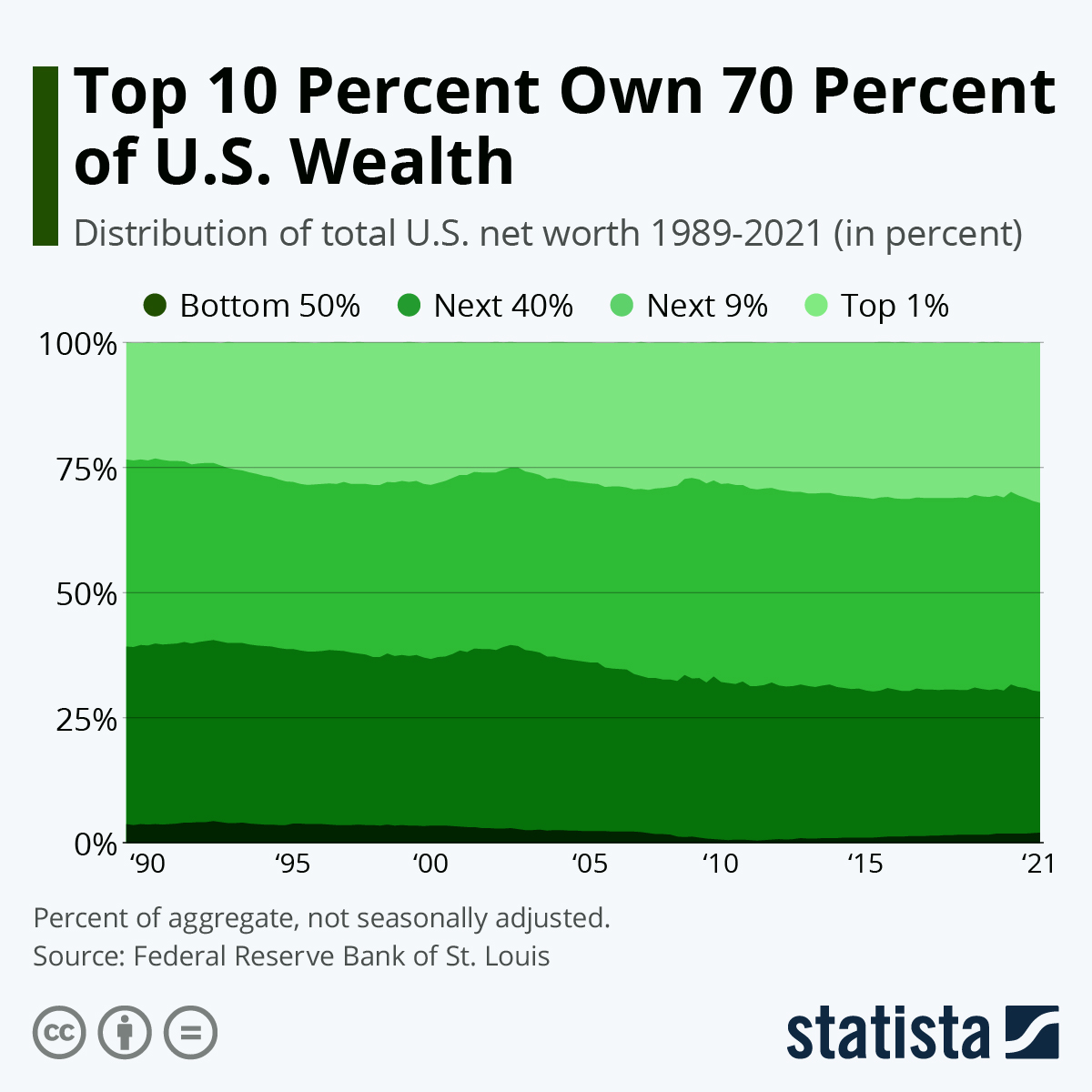

Billionaires around the world have been relatively bearish recently in their public appearances, some including Elon have put their money where their mouth is by cashing out of their stocks selling billions of dollars of equity, they have kept for years and years, but it’s not all bad, for example the world’s greatest stock trader Nancy Pelosi thinks otherwise, examining her most recent disclosure reveals that she has loaded up on in the money option calls for various companies including disney google and salesforce.

a position that seems to indicate a positive year, for at least the tech sector, these calls are in my opinion an extremely aggressive move for anybody, let alone a prominent congresswoman who shouldn’t be trading derivatives in the first place, with her connections and insider knowledge one has to ask themselves how could it be that the world’s most famous billionaire is predicting a recession, while one of the most prominent politicians in this country is anticipating an economic boom, one spoke with his words, the other spoke with her actions.

the story of this doesn’t end there, plenty more billionaires have come out and expressed serious concern about the future of our economy, Raydalio recently went on lex freeman’s podcast where he talked about the collapse of empires, sharing some concerning stats regarding the united states, in the past couple of years rey has been relatively consistent in implying that the us has been on a massive decline, headed towards an economic and social disaster, on the other side stands china, which according to him challenges the us on every level, this belief is common among billionaires,

including Warren Buffett’s right-hand man Charlie Munger you can listen to him speak about this in this 2020 interview where he openly talks about his admiration for what he calls, the chinese economic miracle, « the other thing that’s really remarkable, the last 30 years of china, they have had real economic growth, at a rate for 30 years, that no big country has ever had before in the history of the world, and who did that ? a bunch of communist chinese, now that is really remarkable, so if you’re studying finance you got a lot of strange things to account for,

so bob regenthoff who has a phd in 1979 from marinara clubhearing asked «how would you rate investing in china with the current political tensions, or you invested in china through the ownership of american companies that do business in china »

well i’m of course i’m invested partly in american companies that do business in china including coca-cola, and of course i’ve had very successful experience there, and i think it’s likely to continue, the chinese story is the damnedest thing that it’s a damn decision that ever happened to a big country in terms of economics no other big country ever got ahead this fast, for that long,

so a lot of these elites including elon musk at least imply that the u.s is headed towards a disaster, but we know from simply glossing over an S&P 500 chart, that from a stock market perspective the idea that the us is in a decline, is laughable we can argue back and forth about the true state of this country socially and economically, but due to the nature of modern economics stocks seemingly only go up, for 15 years now we’ve never had an extended period of losses, and as much as humans love hearing that everything is going to crash and the economy is going to the toilet,

Most agree that there is nothing that will bring down this market, other than the federal reserve, it’s well reported that the feds have been contemplating a rate hike for quite a while and based on the infamous dot plot every indication is pointing to the fact that the federal reserve will look to raise the rate three times in 2022.

But these will be small hikes that have likely been already baked into our current market, what everyone is worried about is the future potential of significant, and extended rate hikes, those would undoubtedly heavily damage the economy throughout, but i have a feeling that when a congresswoman known for her positive stock returns, make significant option bets the likelihood of a crash in the next year is very low, and even if there was one, the federal reserve would step in and save the day just like they did in march of 2020.

For Elon the tweet about an incoming recession by 2023 is very interesting when you consider the timing, if you were not aware musk has sold a record amount of tesla stock, whenever an insider does this you have to wonder about the underlying reasons we’ve all seen moves like the ackman push before this is where you publicly state that the market is headed down but before you do so, you also secure either a short or a massive cash position, this way when your crash happens, you step in and scoop up even more shares at a massive discount,

if we look at tesla i think even Elon knows it’s massively overvalued, way back in the day he tweeted that tesla at 420 is Too high, something that at the time crashed the stock and made him trend on social media, now years later the stock is well past that number nearly percent higher and no one is batting an eye, in fact on january 3rd the stock rose 13 in one day for producing in one year what toyota does in one month, an absurd evaluation that is hard to quantify using classic stock analysis techniques, predicting the future of markets is difficult if not impossible but it’s hard to be bearish when you look at a chart like this, and when you stare at a disclosure showing how a congresswoman is buying derivatives that have consistently printed money for her and her husband,

Check out this article, you might also like it: 10-most-weird-economic-indicators-that-will-shock-you